The 2023 Board Diversity Index has been recently released, presenting the survey results of the ASX 300. The report published by Watermark and the Governance Institute of Australia highlights significant changes in board diversity trends in Australia. This summary provides an overview of their findings and offers insights into the implications for those seeking a board appointment.

The representation of genders on Australian boards

In 2023, female representation on Australian ASX 300 boards continued to succeed the 30% benchmark. Female board seats have risen to 35% in the last 12 months. This is an 80% increase since 2016. With the female talent pool continuing to expand, the ratio of men to women on boards is predicted to be close to equal by 2030.

The latest AICD Gender Diversity Report noted similar findings, with 35.6% of ASX 300 board seats being held by women and 67% of ASX 300 boards having more than 30% female representation. Of the 759 board seats held by women, 685 of these are non-executive director roles. Whilst this is good news, more work must be done before we see more women in board chair roles. However, in the past 12 months, the AXS 20 companies have reported an increase from 10 to 25 per cent of women appointed as CEOs.

The cultural diversity of Australian directors remains unchanged

According to the data, it is still the case that 90% of ASX 300 Directors are Anglo-Celtic. This is not in line with the general population trends, with the growing proportion of Australians being of Asian descent. There has also been little change in the number of indigenous ASX 300 directors, with only four directors holding six seats.

Director Skills, Experience & Qualifications

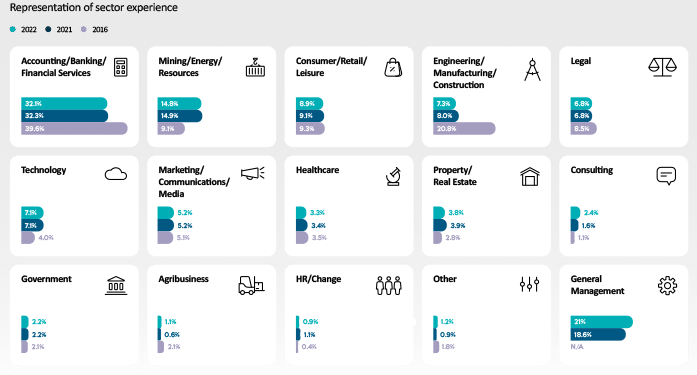

This year’s report has seen little trend changes in directors’ skills, experience and qualifications.

There is a continued decline in the number of board directors with experience in accounting/banking/finance, engineering/manufacturing/construction, and legal sectors; and a rise in the number of directors with experience in the mining/energy/resources and technology sectors.

These statistics include

- 82% hold an Undergraduate Degree, 19% hold an MBA and 7% a PhD

- 17% hold a Finance Qualification, 36% hold a Governance Qualification

- 32% have Accounting/Banking/Finance experience

- 14.8% have Mining/Energy/Resources experience

- 6.8% have Legal experience

- 7.% have Technology experience

- 5.2% have Marketing/Communication/Media experience

It is worth noting that most Directors have no formal Governance Qualifications. This supports my advice that a Governance Qualification will enhance directorial skills but does not guarantee a board appointment.

The age diversity of directors in Australia

The average age of ASX 300 Directors is 60.15 years old, with a minimal age difference between the genders. The average age for men is 61.8, and for women is 58.1. These figures have remained relatively stable in recent years and are not expected to change significantly in the near future, but let’s see as these aging directors retire from their roles. There has already been some progress with more younger directors appointed in the technology, telco and resources sectors.

Location

The percentage of directors has declined slightly from 33% to 31%, with New Zealand, North America and the United Kingdom dominating the locations of overseas-located directors. Even in our digitally connected world, boards are more comfortable appointing local directors.

Board Tenure

Accordingly, 65.2% of board directors and 72.5% of board chairs have tenures of less than 10 years, with minimal changes observed, especially for chairs. It is anticipated that board directors and/or chairs who serve on the same board for more than 15 years will face the risk of becoming increasingly rare.

The phrase “White, male and stale” is becoming less common, but what impact does this have on you?

Securing a board appointment has always been a competitive process, regardless of factors such as gender, age, or professional background. Even if you possess strong qualifications, it is essential to effectively communicate your unique value compared to other candidates who may bring different perspectives or more extensive experience.

While these diversity studies provide helpful information, it is essential to note that it focuses solely on ASX300 companies and may not accurately represent the larger NED community. In many organisations, older directors may be seen as out of touch with trends in market competitiveness, regulatory conditions and ways of working.

These findings suggest that board appointments are shifting (although a little slower with the top ASX companies), with the “old guard” of non-executive directors (NEDs) stepping down and being replaced by new NEDs who possess different skills, experience, and demographics to adapt to evolving business environments.

This is partially supported by the predictions made in this diversity study.

- Finance and accounting skills are declining at the board level, while technology, marketing, and resources experience are rising.

- The desired focus for the future is on marketing and branding experience, specifically with a background in change management.

- The tenures of current board directors are expected to decrease.

- The representation of female directors is expected to grow.

Resources

About the Author

David Schwarz is CEO & Founder of Board Direction – Australia’s leading board advertising and non-executive career support firm. He has over a decade of experience of putting people on boards as an international headhunter and a non-executive recruiter and has interviewed over one thousand non-executives and placed hundreds into some of the most significant public, private and NFP roles in the world

Share this article on your favourite platform!